Resolve Estate Conflicts: Guide to Family Inheritance Peace

Resolving Inheritance Conflicts: A Straightforward Guide to Family Peace After Loss

Don't let inheritance battles destroy your family. Learn practical, no-nonsense strategies to manage disputes and preserve relationships during a difficult time.

Losing a family member is an inherently painful experience. Grief, sadness, and the disruption to family dynamics are challenging enough. For many families, the already turbulent waters of bereavement are further roiled by inheritance disputes. What should be a period of collective mourning and remembrance can quickly devolve into arguments, resentment, and fractured relationships, all stemming from disagreements over the deceased's estate.

It's a stark reality: the distribution of assets, intended to provide security and connection, can become a major source of division. This isn't just a plot device in a drama series; it's a common occurrence in the United States, impacting families across all socioeconomic spectrums. Understanding why these conflicts arise and, more importantly, how to navigate them constructively is crucial for preserving family harmony when it's needed most.

This guide offers a direct, practical approach to managing family conflicts related to inheritance. We will examine the statistical reality of these disputes, pinpoint common triggers, learn from well-known examples, and provide actionable strategies to help families navigate these challenging situations with clarity and, ideally, maintain their familial bonds.

The Undeniable Reality: Inheritance Disputes Are More Common Than Comfortably Acknowledged

While often a private matter, the frequency of inheritance disputes is statistically significant, indicating a widespread societal issue.

Key Statistics:

- Rising Disputes: The prevalence of inheritance disputes is not just anecdotal; it's statistically on the rise. The number of inheritance disputes brought before judges has more than doubled in the last decade4, 5. This upward trend underscores the increasing complexity of family dynamics and estate settlements.

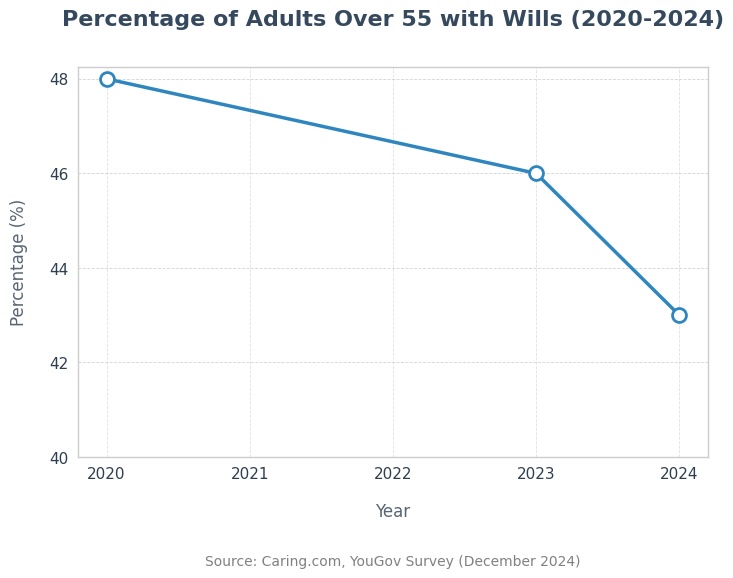

- Frequency: While exact figures are elusive due to the private nature of estate settlements, legal professionals consistently report a high incidence of inheritance disputes. Estimates suggest that disagreements arise in a substantial portion of estates, with some lawyers estimating up to one-third of estates experiencing some form of conflict. A 2024 article by [USA Today] 16 indicates that only 32% of Americans have a will, highlighting the potential for increased disputes due to lack of planning. Furthermore, research from the University of Alberta directly underscores this point. "We found that conflict is quite common during bereavement," states Dr. Donna Wilson, lead researcher of a study on family conflict during bereavement. "Almost half of our participants reported experiencing conflict with family members during the year and a half following the death of a close relative." 15

- Lack of Planning: A significant factor contributing to these disputes is the lack of proper estate planning. Approximately 55% of adult Americans do not have an estate plan or will in place6, leaving asset distribution to state laws and increasing the likelihood of family disagreements.

- Financial Cost: Inheritance disputes are not just emotionally taxing; they are financially draining. Legal fees can be substantial, ranging from $250 to $1,000 per hour depending on location, and these costs escalate, especially if the case goes to trial. Will contests can last months or years, potentially exceeding the contested assets' value, incurring legal costs and consuming your personal financial resources. This financial strain adds another layer of stress during an already difficult time. Moreover, settling an estate through probate court can be costly. In Illinois, for example, probate can average around $12,5006. Nationally, Americans pay an estimated $2 billion a year for probate, much of which could be avoided with careful estate planning6 17.

- Emotional Toll: Beyond the monetary costs, the emotional damage inflicted by inheritance disputes is often the most devastating and long-lasting consequence. These conflicts can exacerbate pre-existing family tensions, create deep rifts between siblings or relatives, and leave emotional scars that can persist for generations. The intensity of these conflicts should not be underestimated. As Dr. Wilson from the University of Alberta study explains, "These conflicts weren't just minor disagreements. They were often described as intense, frequent and distressing." 15

Factors Contributing to Rising Disputes:

- Complex Family Structures: Blended families and non-traditional relationships add layers of complexity to inheritance, increasing the potential for disputes4, 5, 2.

- Increased Awareness of Rights: Greater public awareness of the right to challenge wills and estate plans contributes to the rise in litigation4, 5.

- High Property Values & Rising Costs: Significant asset values, especially in real estate, and increasing living costs can intensify the stakes in inheritance disputes, making disagreements more likely4, 5.

- Dementia Cases: The increasing number of dementia cases can complicate estate planning and lead to disputes regarding testamentary capacity and undue influence4, 5.

- Poorly Written or Outdated Wills: A will that is unclear, legally deficient, or outdated can be a major source of conflict, as it leaves room for interpretation and challenges5.

Famous Cases: When Inheritance Disputes Become Public Spectacles

High-profile inheritance battles involving celebrities and wealthy families serve as cautionary tales, illustrating how even with significant resources and legal counsel, family dynamics and perceived unfairness can ignite intense and public disputes.

- The Jimi Hendrix Estate: The legendary guitarist's estate became a decades-long legal saga after his death in 1970. Disputes arose over the rights to his music catalog and image, involving his father, half-sister, and various business entities. The case highlights the complexities of intellectual property rights and the potential for protracted battles even when a will exists. 10

- The Anna Nicole Smith Estate: The model and reality TV star's estate became a media frenzy after her death in 2007. A complex legal battle ensued over her late husband's (J. Howard Marshall II) fortune, involving her son, her partner, and Marshall's son. The case exemplifies how blended families and unclear intentions can lead to highly publicized and contentious inheritance disputes, ultimately reaching the Supreme Court. 11

- The Prince Estate: The music icon Prince's lack of a will upon his death in 2016 triggered a years-long legal process to determine his heirs and distribute his vast estate. The case underscores the critical importance of having a will, even for those who may believe their affairs are straightforward. Numerous potential heirs emerged, leading to significant delays and legal complexities. 12

These well-known cases, while extreme examples, underscore a fundamental point: inheritance disputes are not confined to specific income brackets. They can affect families from all walks of life when communication breaks down, and perceptions of fairness diverge.

Common Triggers: Why Inheritance Conflicts Erupt

Identifying the common catalysts for inheritance disputes is crucial for proactive prevention and management. Several factors frequently contribute to these conflicts:

Triggers Related to Estate Matters:

- The University of Alberta study, while broadly focused on bereavement conflict, notes that common triggers often revolve around "decision-making about the estate, possessions, and financial matters." [8] (#references) This directly highlights how estate-related decisions, including inheritance distribution, become flashpoints for family disagreements during an already emotionally vulnerable time. Other common triggers include:

- Absence of a Clear Will or Estate Plan: This is a primary instigator. When there's no will (intestacy), state law dictates asset distribution, which may not align with family expectations or the deceased's wishes. Even with a will, ambiguities or outdated documents can breed confusion and disagreement5.

- Perceived Inequity: Even with a legally sound will, beneficiaries may perceive the distribution as unfair. This can stem from unequal shares, specific items of sentimental value, or a belief that one sibling was favored. "Fairness" is subjective and a potent source of conflict.

- Complex Family Dynamics: Pre-existing family tensions, sibling rivalries, blended family complexities, and strained relationships are amplified during estate settlement2. Inheritance can become a battleground for unresolved emotional baggage and long-held grievances.

- Lack of Transparency and Communication: Secrecy surrounding estate planning or a lack of open communication after death fosters suspicion and mistrust. When beneficiaries are kept uninformed, assumptions and anxieties proliferate, often leading to conflict7.

- Sentimental Value vs. Monetary Worth: Disagreements frequently arise over items with high sentimental value but low monetary worth. Family heirlooms, photographs, or personal belongings can become fiercely contested, even if their financial value is minimal1.

- Executor/Trustee Actions (or Perceived Mismanagement): If beneficiaries believe the executor or trustee is not acting in the estate's best interest, is negligent, or is engaging in self-dealing, it can trigger disputes and legal challenges7.

Practical Strategies: Navigating Inheritance Conflicts Constructively and Minimizing Damage

While preventing all disputes is unrealistic, proactive measures and clear communication can significantly reduce the likelihood and severity of inheritance conflicts.

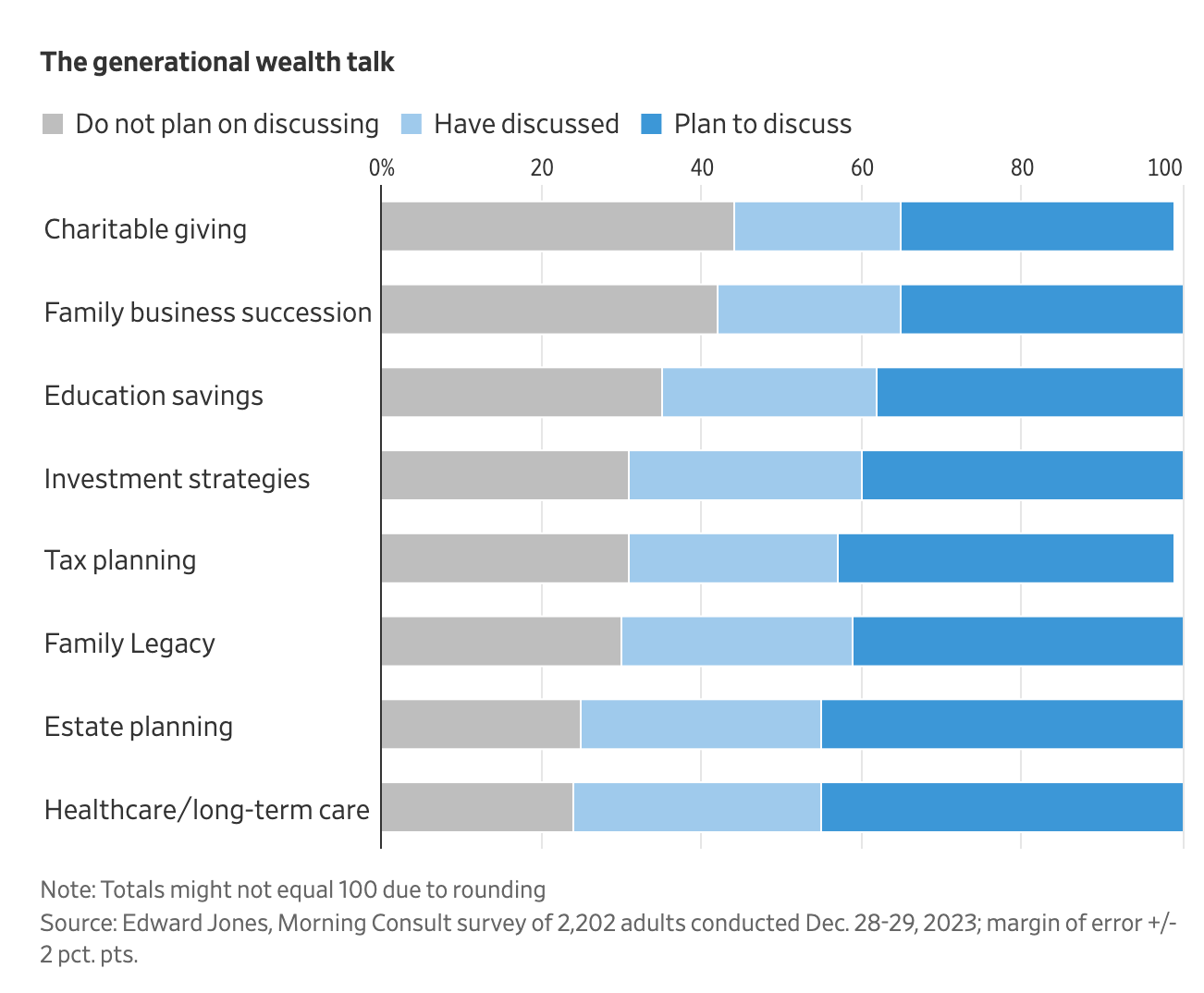

"With people living longer, the wealth transfer conversation needs to be a dynamic, ongoing dialogue. 'The Talk' must happen before 'The Transfer.' Our research found that there are a lot of assumptions about inheritance, but limited effort to clarify through a discussion. 'The Talk' is critical to manage family harmony, uncertainty, and the financial complexity of passing wealth." - Edward Jones 14

Here's a straightforward, actionable approach:

-

Prioritize Proactive Estate Planning (Well Before It's Needed):

- Comprehensive Estate Plan: Establishing a clear and comprehensive estate plan is the most effective way to prevent family conflict during probate3. This includes not just a will, but potentially trusts and other estate planning tools.

- Facilitate Open Family Discussions: If feasible, initiate honest conversations with family members about the estate plan. Open communication can help everyone understand the intentions and reduce misunderstandings7, 1.

- Create a Comprehensive and Unambiguous Will or Trust: Engage an experienced estate planning attorney to draft legally sound documents that clearly delineate asset distribution and executor/trustee responsibilities. Minimize ambiguity and address potential points of contention directly. Ensure the will is clear, legally binding, and up-to-date to avoid future disputes5.

- Regular Updates: Review and revise the estate plan periodically to account for life changes, ensuring heirs receive due consideration and that the plan remains aligned with current wishes8.

- Fair Distribution System for Personal Property: Agreeing on a system for dividing personal property can preempt arguments. Consider methods like taking turns choosing items or conducting a lottery1.

- Liquidation of Complex Assets: For complicated assets like real estate or businesses, consider selling them and dividing the proceeds, or allowing one beneficiary to buy out the others for a smoother, less contentious distribution1.

- Consider a Letter of Intent (Non-Binding but Clarifying): A non-legally binding letter can accompany the will, explaining the rationale behind certain decisions and expressing wishes for family harmony. This can provide valuable context and emotional reassurance.

-

Post-Death: Emphasize Communication and Transparency:

- Maintain Open and Honest Communication Channels: The executor/trustee should communicate openly and regularly with beneficiaries, providing timely updates on the estate settlement process. Address questions and concerns promptly and transparently7. Remember, the estate executor may spend a significant amount of time settling the estate, potentially averaging 570 hours6, so clear communication is essential throughout this process.

- Organize Family Meetings for Clarity: Consider scheduling family meetings to discuss the will, the estate inventory, and the proposed distribution plan. This provides a structured forum for questions, clarifications, and airing concerns in a controlled environment.

- Utilize Professional Mediation Services: If disagreements arise, consider engaging a neutral mediator specializing in estate disputes. Mediation can offer an impartial perspective, guide discussions, and help families reach a compromise without resorting to court battles1, 3. Mediation is an example of Alternative Dispute Resolution (ADR), which also includes methods like arbitration or collaborative law, offering less adversarial ways to resolve conflicts7.

-

Focus on Family Relationships Over Financial Assets:

- Acknowledge and Validate Emotions: Recognize that grief and heightened emotions are inherent during this period. Allow space for family members to express their feelings and validate their emotional responses.

- Practice Empathy and Perspective-Taking: Actively try to understand other family members' viewpoints and motivations. What may seem unreasonable from one perspective may be understandable from another's.

- Prioritize Long-Term Family Harmony: Remind everyone that preserving family relationships is often more valuable than "winning" a dispute over assets. Consider the enduring cost of fractured family bonds versus the temporary nature of financial gains.

- Focus on the Estate's Best Interest: Throughout the resolution process, prioritize the deceased's intentions and work towards a solution that preserves the estate's value and honors their wishes7.

-

Understand Your Legal Rights (and Limitations):

- Seek Legal Counsel When Necessary: If disputes escalate or you believe your legal rights are being infringed upon, consult with an experienced estate litigation attorney. Understand your legal options, the potential costs, and the realistic outcomes of legal action.

- Familiarize Yourself with State Inheritance Laws: Inheritance laws vary significantly by state. Gain a basic understanding of the relevant laws in your jurisdiction to comprehend the legal framework governing estate settlement.

- View Litigation as a Last Resort: Court battles should be considered a final option. They are expensive, time-consuming, emotionally draining, and often inflict further damage on family relationships.

Straightforward Advice - Key Takeaways:

- Document Everything: Maintain meticulous records of all communication, decisions, and estate-related transactions.

- Be Reasonable and Realistic in Expectations: Understand that estate settlement is rarely perfectly seamless. Be prepared for compromises and unexpected challenges.

- Center on What Truly Matters: In the face of loss, remember the enduring importance of family and shared history. Don't allow financial disagreements to overshadow these fundamental values.

What to Do Next:

Inheritance disputes can be a painful and unfortunately common reality for many families. Instead of waiting for issues to arise, take proactive steps to address potential conflicts. Start by understanding the common causes of these disputes. Prioritize open and honest communication within the family, creating a safe space for expressing concerns and expectations. Consciously focus on preserving family relationships, recognizing that these bonds are often more valuable than any material inheritance.

Engage in proactive estate planning, seeking professional guidance to ensure your wishes are clearly documented and legally sound. Finally, commit to respectful dialogue, even when disagreements arise. By taking these actions, you can foster family harmony during a time of grief and transition, and ensure that the most enduring legacy is one of love and connection, not conflict. Don't let potential disputes diminish that legacy – take action now.

References:

- [1] Western & Southern Financial Group - Strategies for Avoiding Family Inheritance Disputes

- [2] My Family Estate Planning - Preventing Inheritance Disputes in Blended Families

- [3] The Chamberlain Law Firm - Family Conflict After Death: Family Conflicts During Probate

- [4] Warner Goodman LLP - The Rise in Inheritance Disputes

- [5] Ernest Grant - Number of Inheritance Disputes Doubled in Last Decade

- [6] Estate & Probate Legal Group - Probate Facts and Figures

- [7] Anton Legal Group - Resolving Inheritance Disputes: Strategies for Beneficiaries and Executors

- [8] Investopedia - Estate Planning

- [9] Psychology Today - Family Conflict During Bereavement

- [10] The Guardian - Estates of Jimi Hendrix Bandmates Can Sue Over Royalties Dispute

- [11] Supreme Court - Anna Nicole Smith Estate Case

- [12] The Guardian - Prince Estate Finally Settled Six Years After His Death

- [14] Edward Jones - Great Wealth Transfer Research

- [15] University of Alberta - Family Conflict During Bereavement

- [16] USA Today - Fewer Americans Writing a Will

- [17] The Chamberlain Law Firm - Probate Costs

Disclaimer: This guide provides general information for educational purposes and should not be considered legal, financial, or tax advice. Laws and regulations vary significantly by state, and specific estate situations can be complex. It is essential to seek tailored advice from qualified professionals, including an attorney specializing in estate and probate law, a certified public accountant (CPA), and/or a certified financial advisor, to address the unique circumstances of your situation.

Contact Us

Stairway is currently building AI driven technology to make estate settlement and administration easier. If you are interested in learning more about our technology, please reach out to us.

Contact Form: Contact Us

We look forward to hearing from you!