Decoding Probate: How Much Does Your Estate Need to Be Worth?

Decoding Probate: How Much Does Your Estate Need to Be Worth?

A Straightforward Guide to Understanding Probate Thresholds in the US and When They Matter.

Probate. It's a word that often conjures up images of lengthy legal battles and drained inheritances. For many, it's a process shrouded in mystery, and a key question often arises: when does an estate actually have to go through probate? The answer isn't a simple dollar figure, but understanding the nuances can save your loved ones significant time and stress down the line.

This isn't about scare tactics or legal jargon overload. Consider this a clear, no-nonsense guide to understanding estate values and probate in the US. We'll cut through the complexity, offering straightforward information so you can better prepare yourself and your family.

Key Statistics: Probate by the Numbers

Before we dive into specific thresholds, let's get a sense of the landscape. While precise, nationwide statistics are challenging to pinpoint due to varying state laws, here are some telling data points:

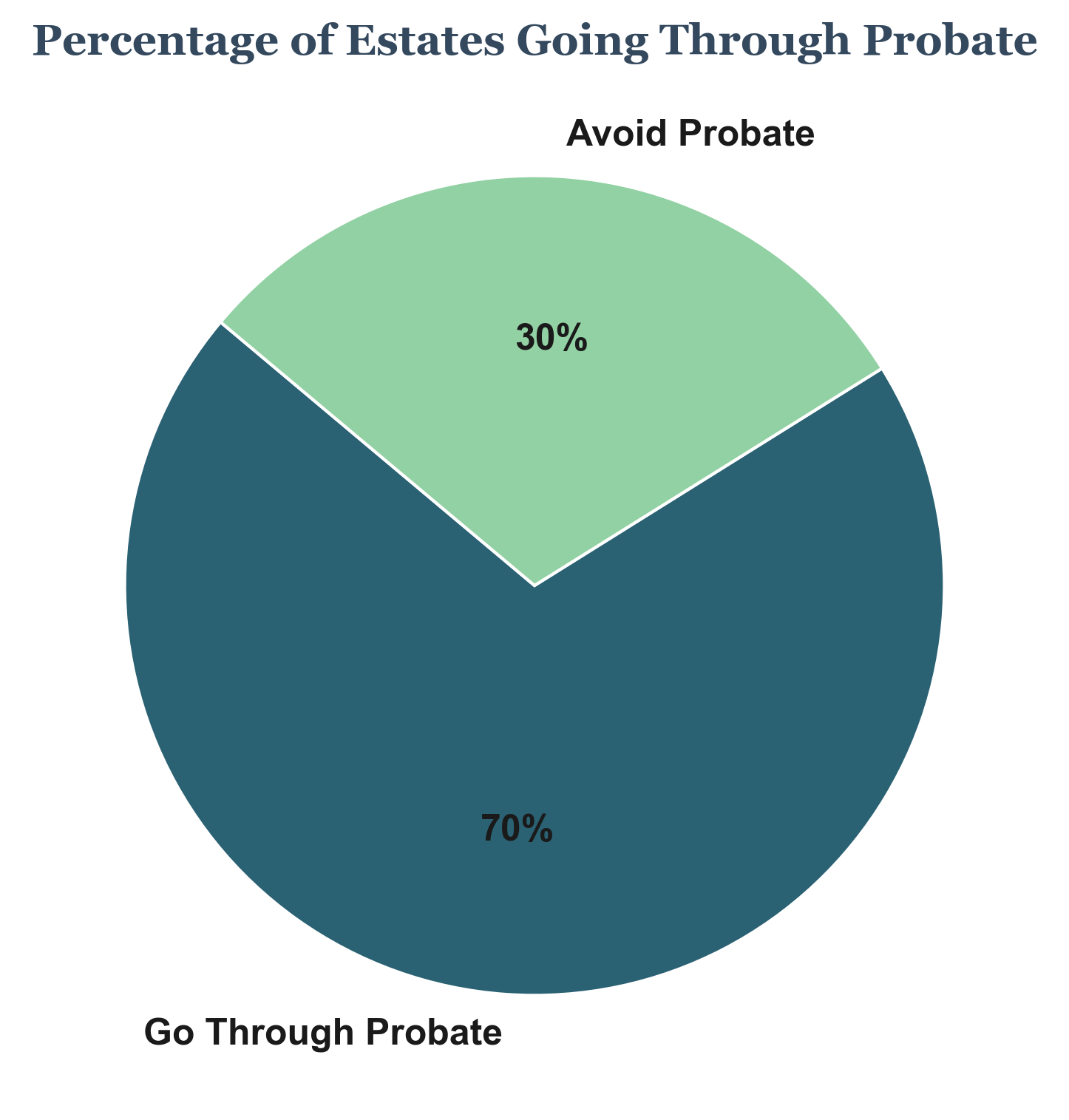

- Percentage of estates going through probate: Estimates vary, but a significant portion of estates in the US will go through some form of probate. Some sources suggest it could be anywhere from 50% to 70% of estates that don't have robust estate planning in place 1. This highlights that probate is not an uncommon process.

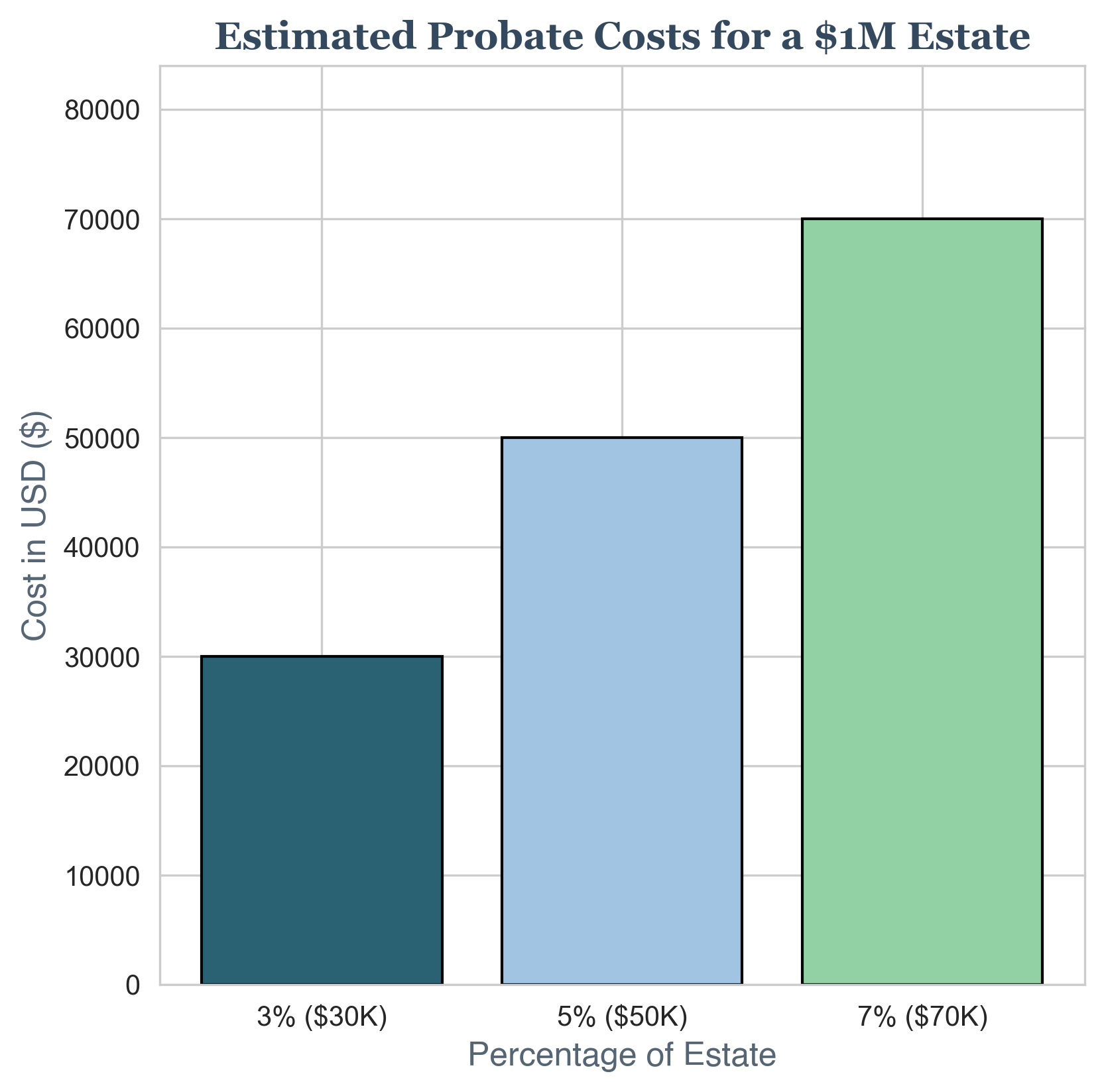

- Cost of probate: Probate costs can eat into an inheritance. Fees can range from 3% to 7% of the estate's value, sometimes even higher depending on the complexity and location 2. For a sizable estate, this can represent a substantial amount.

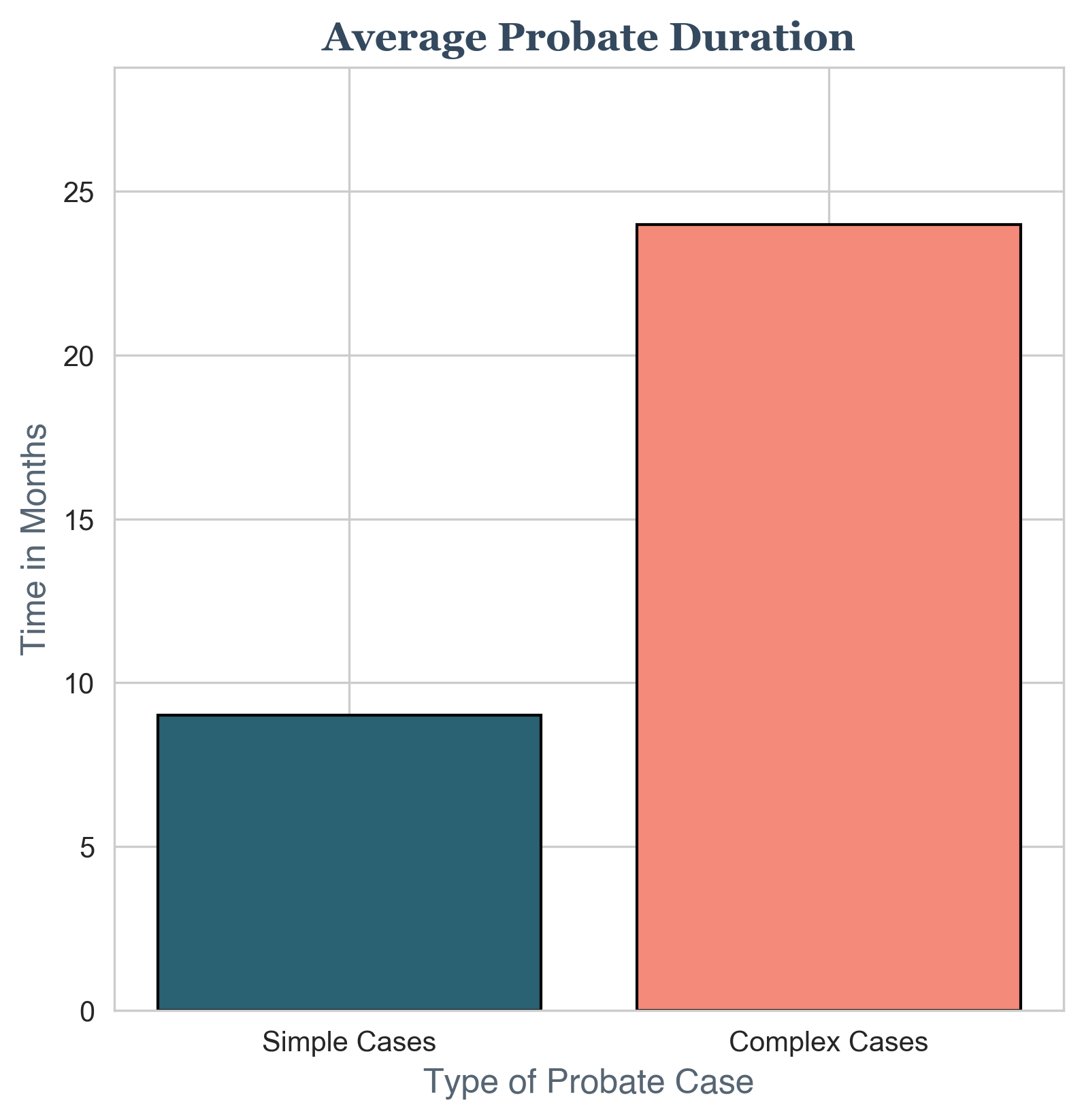

- Time to complete probate: The probate process isn't quick. Even simple estates might take 6-12 months in California, while more complex ones can drag on for years 3. This delay can be emotionally taxing for grieving families.

These statistics underscore why understanding and potentially mitigating probate is a worthwhile endeavor.

The Threshold Question: It's Not Just About the Dollar Amount

The crucial point to understand is that there isn't a single, federal probate threshold in the US. Probate laws are determined at the state level. Each state sets its own rules and exemptions regarding when probate is required.

Generally, probate is triggered when a person dies owning assets in their individual name without a mechanism to automatically transfer them to someone else. This "mechanism" often comes in the form of:

- Joint Ownership: Assets held jointly with "rights of survivorship" automatically pass to the surviving owner, bypassing probate for that portion.

- Beneficiary Designations: Accounts like life insurance, retirement accounts (401(k)s, IRAs), and some brokerage accounts allow you to name beneficiaries. These assets go directly to the named individuals, outside of probate.

- Living Trusts: Assets held in a properly funded living trust are legally owned by the trust, not the individual, and are managed according to the trust's terms, avoiding probate.

So, it's less about the total value of everything you own worldwide, and more about the value of assets that will pass through your probate estate. This "probate estate" consists of assets that don't have these automatic transfer mechanisms in place.

State-Specific Exemptions: Small Estate Limits

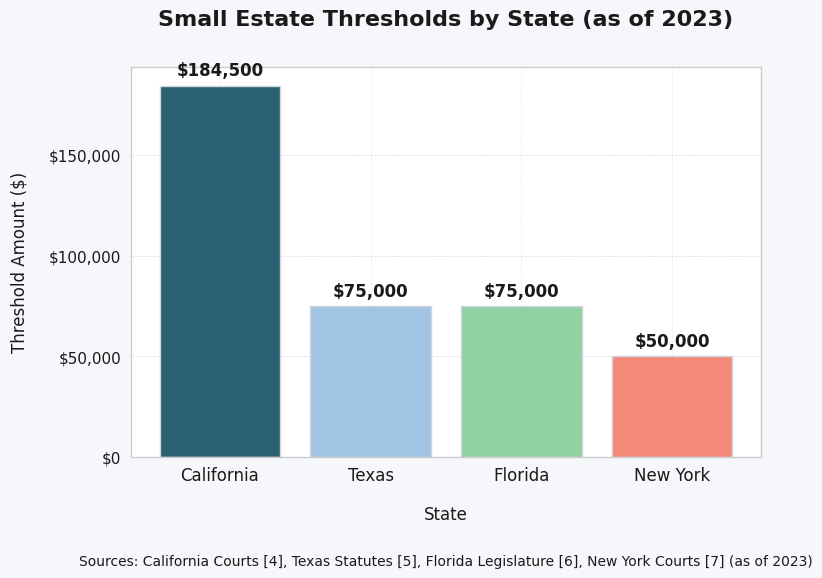

To simplify the process for smaller estates, most states have what are called "small estate" procedures. These procedures allow estates below a certain value to bypass formal probate or go through a much simpler, faster version.

These "small estate limits" vary significantly by state. Here are some examples to illustrate the range:

- California: For personal property, the limit is $184,500 (as of 2023). For real property, it's more complex and depends on the type of property and its value 4. California also has a simplified probate process for estates under $184,500 in total gross value (including both real and personal property, but with some exclusions).

- Texas: Texas has a very low threshold for its "small estate affidavit" process, currently at $75,000 in personal property (excluding the homestead and certain exempt property) 5.

- Florida: Florida's "summary administration" (a simplified probate) is available if the value of the probate estate is less than $75,000, or if the decedent has been deceased for more than two years 6.

- New York: New York allows for "voluntary administration" (a simplified process) for estates with personal property valued at $50,000 or less 7.

Important Note: These limits are subject to change, and the specific rules and exclusions can be complex. Always check the current laws of the state where the deceased person resided. State bar associations and court websites are good starting points for finding this information.

Examples Cases for Probate

Consider the case of Maria Rodriguez, a resident of Texas. Maria passed away unexpectedly, leaving behind a modest home worth $150,000 (with a mortgage), a car worth $10,000, and a bank account with $60,000 in her name alone. Because her bank account and car, totaling $70,000 in probate assets (home excluded due to mortgage and homestead exemptions in Texas in this simplified example), fell under the Texas small estate affidavit limit of $75,000, her family could likely use this simplified process to transfer these assets. This would be significantly faster and less expensive than formal probate.

However, if Maria had lived in California and owned a similar portfolio of assets, the situation could be different. While her personal property might still fall under California's small estate limit, the rules are more intricate, especially concerning real estate. Her estate might still require some form of probate depending on the specifics.

For another case let's look at David Chen, a resident of Florida, who passed away owning a condo (homestead, likely non-probate), a car worth $8,000, and a bank account with $40,000. In Florida, homestead property often passes directly to heirs outside of probate. Therefore, for probate assets, we look at David's car and bank account, totaling $48,000.

Florida offers a simplified probate process called Summary Administration for estates with probate assets valued at $75,000 or less. Because David's probate assets of $48,000 fall well under this limit, his family could likely utilize Summary Administration to transfer these assets. This streamlined approach would be significantly faster and less expensive than formal probate in Florida, particularly since his primary residence as homestead is likely excluded from probate altogether.

Now, consider Linda Davis, a resident of California who, despite some estate planning, still faces formal probate. Linda wisely placed her San Francisco home into a Revocable Living Trust and designated beneficiaries for her $450,000 401k, effectively avoiding probate for these major assets, much like the homestead exemption might simplify matters in Florida. However, she also owned a brokerage account worth $200,000 and a checking account with $60,000, neither of which had Transfer on Death (TOD) or Payable on Death (POD) designations.

In California, while trusts and beneficiary designations are powerful tools to bypass probate, assets without such planning and exceeding the state's small estate threshold will be subject to formal probate. Linda's brokerage and checking accounts, totaling $260,000, surpass California's limit for simplified probate. Therefore, even with her proactive trust and 401k planning, her family would likely need to navigate formal probate administration to legally transfer the remaining $260,000 in assets to her heirs due to the lack of TOD/POD designations on those accounts. This illustrates that even with diligent planning for major assets, overlooking smaller accounts or failing to utilize TOD/POD options can still trigger the need for formal probate in California, unlike the potentially more streamlined process for David in Florida.

Key Takeaways and How to Potentially Avoid Probate

Understanding probate thresholds is the first step. Here's what you should consider:

- Know Your State's Laws: Research the probate and small estate laws in your state of residence. State bar websites and legal aid organizations are valuable resources.

- Inventory Your Assets: Make a list of your assets and how they are titled. Identify assets that would likely go through probate (individually owned without beneficiary designations).

- Consider Estate Planning Tools:

- Beneficiary Designations: Maximize beneficiary designations on all eligible accounts. Your 401k/IRA/etc. will have a beneficiary designation form that you can fill out.

- Joint Ownership: For jointly owned property, understand the implications of "rights of survivorship."

- Living Trusts: Explore whether a living trust is appropriate for your situation. Trusts can be effective tools for avoiding probate and managing assets.

- Pay-on-Death (POD) and Transfer-on-Death (TOD) Designations: These allow you to name beneficiaries for bank accounts (POD) and brokerage accounts/securities (TOD), keeping these assets out of probate in many states.

- Consult with an Estate Planning Attorney: For personalized advice and to create a robust estate plan, consulting with an experienced estate planning attorney is highly recommended. They can guide you through the complexities of your state's laws and tailor a plan to your specific needs and circumstances.

Final Thoughts: Proactive Planning is Key

Probate isn't inherently bad, but it can be time-consuming, costly, and public. Understanding the thresholds in your state and taking proactive estate planning steps can potentially simplify the process for your heirs and ensure your wishes are carried out efficiently. Don't wait until it's too late – take the time to understand your situation and plan accordingly. It's a gift of clarity and peace of mind you can give to yourself and your loved ones.

References

- [1] Example Legal Website - Probate Statistics

- [2] Investopedia - Avoiding Unnecessary Probate Costs

- [3] Nolo.com - Probate FAQ

- [4] California Courts - Check if you can use a simple process to transfer property

- [5] Texas Statutes - Estates Code - Chapter 205. Small Estate Affidavit

- [6] Florida Statutes - Chapter 735 - Summary Administration

- [7] NYCourts.gov - Surrogate's Court - Small Estates

- [8] The State Bar of California