Navigating Loss with Clarity: Your Arizona Estate Settlement Checklist

Navigating Loss with Clarity: Your Arizona Estate Settlement Checklist

Losing a loved one is an emotionally turbulent time. Amidst grief, the responsibility of settling their estate in Arizona can feel overwhelming. Think of this process not as a sprint, but a thoughtful, step-by-step journey. This checklist is designed to be your straightforward guide, cutting through the complexity and helping you navigate estate settlement with clarity and confidence.

Why This Matters: The Numbers Don't Lie

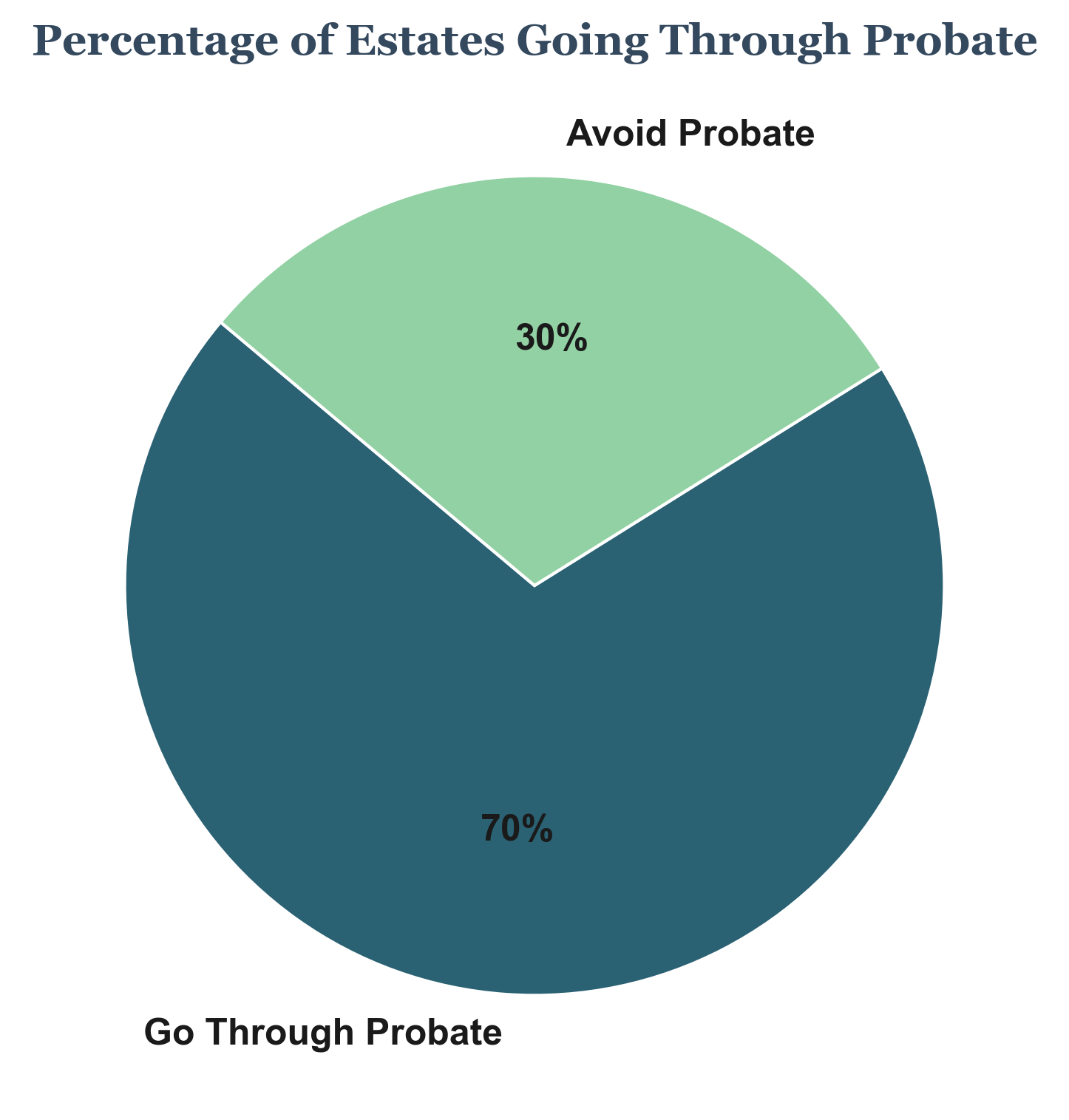

Estate settlement, often called probate, is a reality for many. Here are some key statistics that highlight the importance of understanding this process:

- Over half of Americans die without a will. 1 This statistic underscores the potential for intestate succession (dying without a will) to complicate and lengthen the estate settlement process in Arizona.

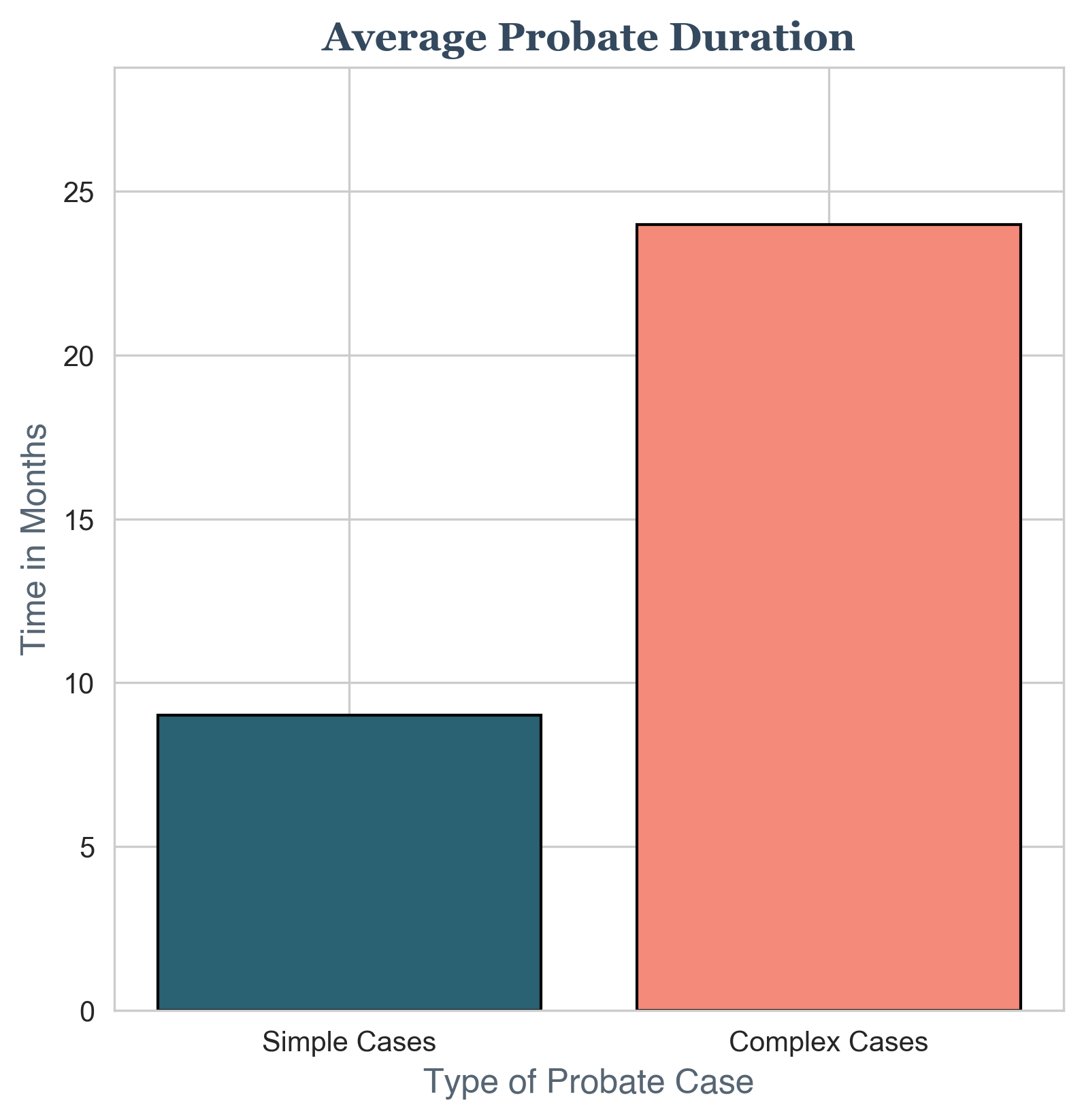

- The average simple probate process in the US can take 6-12 months, and sometimes much longer. 2 Arizona, while aiming for efficiency, can still see probate durations within this range, depending on the estate's complexity.

-

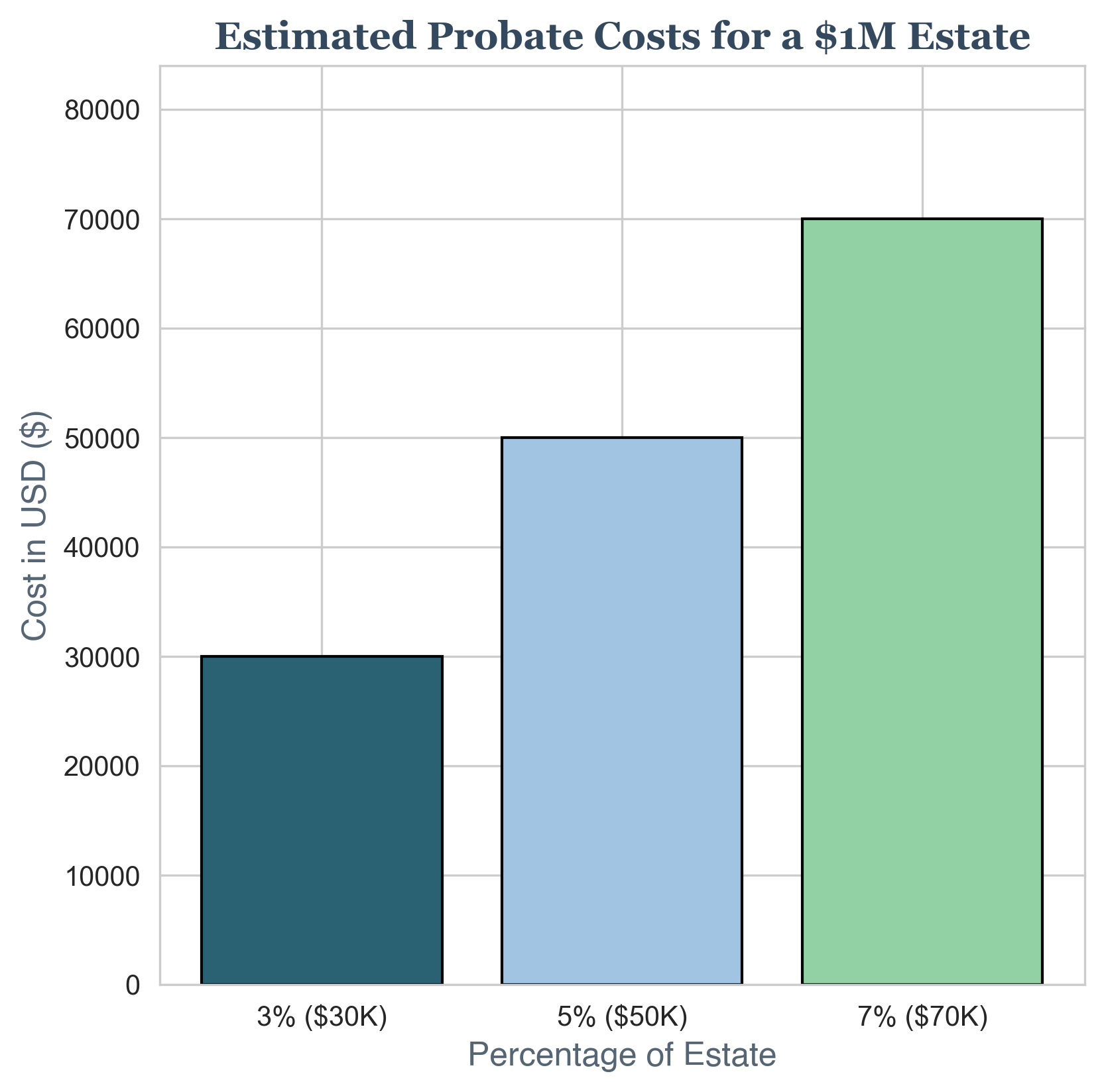

Probate costs can range from 3% to 7% of the estate's value. 3 Understanding the steps involved can help you manage costs and ensure efficient administration.

-

Arizona is a community property state. This means that assets acquired during marriage are generally owned equally by both spouses, which has significant implications for estate settlement, particularly for surviving spouses.

These numbers aren't meant to scare you, but to emphasize the practical need for a clear roadmap. Let's get to that roadmap.

Your Arizona Estate Settlement Checklist: A Step-by-Step Guide

This checklist outlines the typical steps involved in settling an estate in Arizona. Keep in mind that every estate is unique, and the specific requirements may vary. Consulting with an Arizona probate attorney is always recommended for personalized guidance.

Phase 1: Initial Steps & Legal Foundations

- [ ] Secure the Will (if one exists). The original will is a crucial document. It dictates how the deceased wished their assets to be distributed. Look for it in common places like a home office, safe deposit box, or with their attorney.

- [ ] Obtain the Death Certificate. You'll need multiple copies of the death certificate. Funeral homes usually assist with this process. You'll need them for various institutions like banks, insurance companies, and government agencies.

- [ ] Identify the Executor/Personal Representative. The will usually names an executor. If there's no will, or the named executor can't serve, Arizona law dictates who has priority to be appointed as the Personal Representative (PR). This is typically the surviving spouse, then children, etc.

- [ ] File the Will and Petition for Probate (if necessary). In Arizona, probate is generally required if the estate's value exceeds $75,000 in personal property and/or $100,000 in real property. 4 File the will and a Petition for Probate with the appropriate Arizona Superior Court in the county where the deceased resided.

- [ ] Notify Heirs and Beneficiaries. Arizona law requires that all heirs (those who would inherit if there was no will) and beneficiaries named in the will be formally notified of the probate proceedings.

- [ ] Publish Notice to Creditors. You must publish a notice in a local newspaper to inform potential creditors of the estate. This gives them a timeframe to file claims against the estate.

Phase 2: Inventory, Appraisal, and Asset Management

- [ ] Obtain Letters Testamentary or Letters of Administration. Once the court approves the Petition and appoints the Personal Representative, they will issue Letters. These Letters grant the PR the legal authority to act on behalf of the estate.

- [ ] Inventory Estate Assets. The PR is responsible for creating a detailed inventory of all estate assets. This includes real estate, bank accounts, investments, personal property, and any other assets owned by the deceased.

- [ ] Appraise Assets (if necessary). Certain assets, particularly real estate and valuable personal property, may need to be formally appraised to determine their fair market value.

- [ ] Manage and Protect Estate Assets. The PR must manage the estate assets responsibly. This might involve securing real estate, managing investments, and ensuring assets are protected.

- [ ] Open an Estate Bank Account. It's crucial to open a separate bank account in the name of the estate. All estate income and expenses should flow through this account.

Phase 3: Debt Settlement, Taxes, and Distribution

- [ ] Pay Debts and Claims. The PR is responsible for paying valid debts and claims against the estate. This includes credit card debts, medical bills, taxes, and any other outstanding obligations. Arizona law dictates the priority of creditor claims.

- [ ] File and Pay Estate Taxes (if applicable). While Arizona does not have its own estate tax, federal estate taxes may apply to very large estates (over $12.92 million in 2023). 5 The PR is responsible for filing any necessary estate tax returns and paying any taxes due.

- [ ] Prepare an Accounting. The PR must prepare a detailed accounting of all estate income, expenses, and transactions. This accounting is typically provided to the beneficiaries and may need to be filed with the court.

- [ ] Distribute Assets to Beneficiaries. Once all debts, taxes, and expenses are paid, and the accounting is approved, the PR can distribute the remaining assets to the beneficiaries according to the will or Arizona intestate succession laws.

- [ ] Close the Estate. After all assets are distributed, the PR petitions the court to formally close the estate and be discharged from their duties.

Arizona Estate Examples

1. Simple Estate (Arizona Small Estate Affidavit)

Consider Emily Carter, a resident of Arizona. Emily passed away with very few assets requiring formal probate. She owned:

- A car worth $6,000.

- A personal checking account with $20,000.

- Household furnishings and personal effects of modest value.

In Arizona, if the total value of personal property (excluding real estate) is $75,000 or less, and real property is valued at $100,000 or less in equity, and other conditions are met, a Small Estate Affidavit can be used to transfer assets, bypassing formal probate. Emily's estate, consisting primarily of a car and checking account totaling $26,000, falls well below Arizona's small estate limit for personal property. Her family could likely use the Arizona Small Estate Affidavit to efficiently transfer these assets without going through formal probate, making this a simple estate administration.

2. Probate Estate (Requiring Formal Probate in Arizona)

Consider Robert Johnson, an Arizona resident who passed away owning:

- A home in Scottsdale, Arizona, worth $600,000 (no mortgage).

- A brokerage account held individually with $300,000.

- A classic car collection valued at $150,000.

- A standard checking account with $10,000.

Robert's estate significantly exceeds Arizona's small estate affidavit limits. His home alone, valued at $600,000, surpasses the real property equity limit. Furthermore, his brokerage account, classic car collection, and checking account are all probate assets, totaling $460,000 in personal property alone, far exceeding the $75,000 limit. Robert's estate would clearly require formal probate administration in Arizona. His family would need to navigate the full probate process to legally transfer his substantial assets to his heirs, as a Small Estate Affidavit is not applicable due to the estate's value and composition.

3. Estate with Trust (Arizona Estate with Revocable Living Trust)

Consider Susan Lee, an Arizona resident who engaged in proactive estate planning. Susan established a Revocable Living Trust during her lifetime and owned:

- Her primary residence in Phoenix, Arizona, worth $550,000, titled in her Revocable Living Trust.

- A retirement account (IRA) worth $350,000, with beneficiary designations naming her children.

- A small checking account outside of her trust with $30,000, without Payable on Death (POD) designation.

- Personal property (jewelry, furniture) of modest value, also technically outside the trust.

Susan's primary asset, her home, was strategically placed in her Revocable Living Trust. Her IRA also avoids probate due to beneficiary designations. These actions effectively bypass probate for the majority of her wealth. However, Susan's checking account, held outside the trust and without a POD, as well as any personal property not formally transferred to the trust, remain technically probate assets. While the bulk of her estate avoids probate due to the trust, her family might still need to utilize a simplified probate procedure or potentially even a Small Estate Affidavit in Arizona for the remaining checking account and personal property if their combined value falls within the relevant Arizona limits. The Trust, however, ensures that the most significant assets are transferred efficiently and privately outside of the full formal probate process.

Arizona Specifics: What to Keep in Mind

- Small Estate Affidavit: Arizona offers a simplified probate process for "small estates." If the estate meets specific criteria (value under certain thresholds), you may be able to use a Small Estate Affidavit, which is a much faster and less expensive process than formal probate. 6

- Community Property: Arizona's community property laws significantly impact estate settlement for married couples. Understanding how community property is treated is essential.

- Independent Administration: Arizona generally uses "informal" or "unsupervised" probate, also known as independent administration. This means the Personal Representative has more autonomy and less court oversight than in some other states, provided they act responsibly.

Conclusion: Clarity in a Difficult Time

Settling an estate is a significant responsibility, but it doesn't have to be shrouded in mystery. By using this checklist as your guide, understanding the key steps, and seeking professional help when needed, you can navigate this process with greater clarity and confidence. Remember, you're not alone, and resources are available to support you through this journey.

Disclaimer: This guide provides general information for educational purposes and should not be considered legal, financial, or tax advice. Laws and regulations vary significantly by state, and specific estate situations can be complex. It is essential to seek tailored advice from qualified professionals, including an attorney specializing in estate and probate law, a certified public accountant (CPA), and/or a certified financial advisor, to address the unique circumstances of your situation.

Contact Us

Stairway is currently building AI driven technology to make estate settlement and administration easier. If you are interested in learning more about our technology, please reach out to us.

Contact Form: Contact Us

We look forward to hearing from you!